“The road ahead won’t be easy, and it won’t be overnight. I’m doing everything in my power to bring this to a resolution.”

Last Thursday, Darpan Sanghvi, the founder and CEO of Good Glamm Group, finally broke his silence after the murmurs of the house of brands’ crumbling state had reached a crescendo

Once heralded as a rising star in India’s D2C and content-to-commerce ecosystem, Good Glamm Group is on the verge of becoming yet another major casualty from the Indian unicorn club. When we last dove into the company’s state of affairs, it was not dissimilar to the downfall of BYJU’S — a story of acquisitions gone wrong and investor group bailing from the board as things went awry.

Based on information received from sources, Good Glamm Group is now limited to a single coworking space in Delhi’s Greater Kailash neighbourhood. Most employees are now working from home and have not been paid their full salaries for the past several months.

While a portion of the salary was given in early June, it remains unclear whether the rest of the dues will be paid. And that’s just the least of Good Glamm’s worries.

Sanghvi has been pushed to the sidelines and is only tasked with bringing in the investors and the funds to save the company. The company’s venture debt investors — Stride Ventures, Alteria Capital and Trifecta — have stepped in to steer the ship and Arjun Vaidyanathan, a former KPMG professional, was appointed to oversee the restructuring in January this year.

Inc42 further learnt that Vaidyanathan has been informally introduced as the point person for all key financial decisions. And his previous stint at a major company was at Paytm, where he spent six months between May and October 2024, as the head of transformation for the entire group.

This coincided with Paytm’s downsizing and restructuring exercise, which also included the sale of Insider to Zomato (now Eternal) as well as the paring down of Paytm’s stake in foreign companies.

The company has raised more than $350 Mn since inception when it was called MyGlamm and in 2021, it pivoted to a house of brands model.

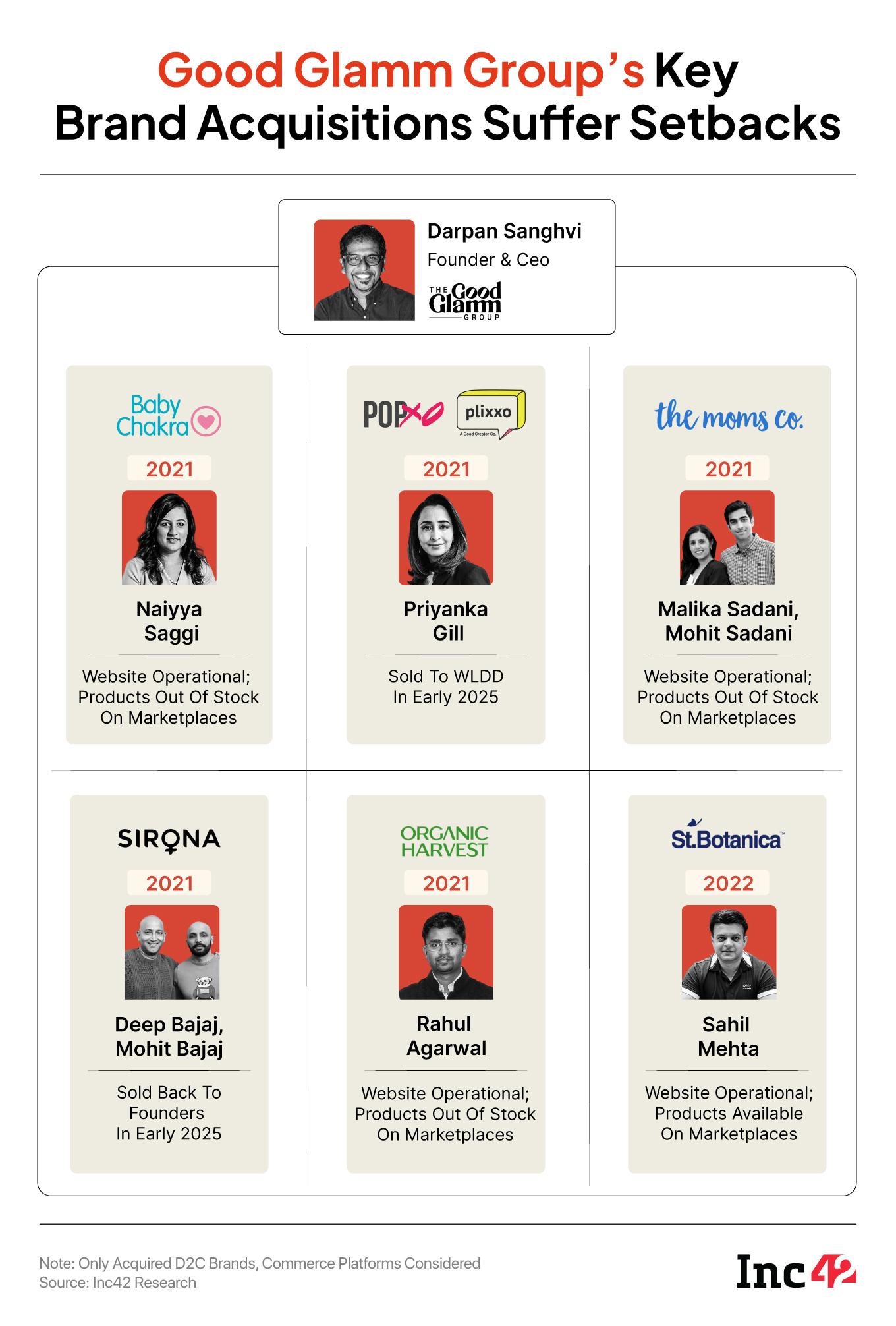

Incidentally, Good Glamm’s crisis is largely a result of this overburdened house of brands, and its failure to execute the strategy that worked for each individual brand before it was acquired in a venture capital-fuelled spree by Good Glamm.

Here’s how it has all but collapsed.

Employees Cast Out, Salaries WithheldOver the past few weeks, the company has been sending a series of internal emails to its about 150 employees every 10 days, attributing delays in dues and uncertainty around payrolls to pending transactions with lenders. These emails, sent from multiple HR IDs, highlight one single issue — that “lenders” are in control.

“As days have turned to weeks and weeks into months, everyone’s frustration has grown. We’ve been sending regular updates via email, but the progress is slow, and that has understandably compounded the collective frustration,” Sanghvi admitted in the LinkedIn post.

In one of these emails sent to the employees, the company says: “…We (the company) had expected the Lenders to close something by the end of June, but while there is progress, they have not been able to close anything yet. This is extremely challenging for all of us, but we are pushing very hard for a deal closure.”

A person close to the company told Inc42 that the company is undergoing a restructuring in conjunction with the lenders of the company “Lenders of the company have taken charge of the financials of the company while Darpan is managing things operationally,” the source said, adding that Vaidyanathan is the one taking all the final calls.

According to the sources, the role of Sanghvi, the founder and CEO of the company, has now been limited to looking for fundraising, mainly to pay vendor dues, repay the venture debt and salaries.

We have reached out to the company regarding this. The story will be published based on the responses.

Notably, Inc42 previously reported that the company was in talks with multiple investors to raise INR 240 Cr in funding at a valuation of INR 1,000 Cr ($120 Mn). At the time, Gujarat-based debt provider and investment broker Veloce Fintech was supposed to lead the round, provided that GGG would bring in other investors.

However, sources say that Sanghvi has been unsuccessful in that direction so far.

Veloce had other conditions as well: existing investors would be massively diluted, Veloce and others would take a controlling stake, and the company would have to reach breakeven in India within six months.

A condition that is extremely difficult to fulfil, given the current state. Unless GGG discards all its brands, it would be next to impossible for the company to scale up even with another infusion, according to some D2C startup founders that Inc42 has spoken to.

Meanwhile, financial distress continues to impact hundreds of employees, many of whom have yet to receive their pending salaries.

Last month, Inc42 reported that the company hasn’t paid them salaries for the last two months, and now the count has grown to three consecutive months.

One of the affected employees told Inc42 they even received Form 16s for the previous financial year, despite not having been paid for multiple months. Some of the Form 16s also allegedly contain inaccuracies.

“We had expected that they [lenders] would have closed a deal by the end of May… but it seems things have gotten pushed back to the end of June,” the company said in one of the emails sent to the employees.

However, the latest update on June 13 again cited the lack of closure and no concrete date on when payments will be made.

Distress Sale Talks UnderwayIn an effort to offload assets and potentially return cash to lenders, Good Glamm Group has also been approaching founders of its remaining acquired portfolio companies, offering them the option to buy back their brands.

Inc42 has learnt that at least two of these founders are evaluating these offers and that preliminary conversations have begun, though no official terms have been disclosed.

Sirona, for example, was sold to Good Glamm for around INR 450 Cr, but the founders bought it back for INR 150-200 Cr.

Furthermore, brands like Organic Harvest reportedly have liabilities of approximately INR 60 Cr to INR 70 Cr, which makes them difficult to acquire for potential investors.

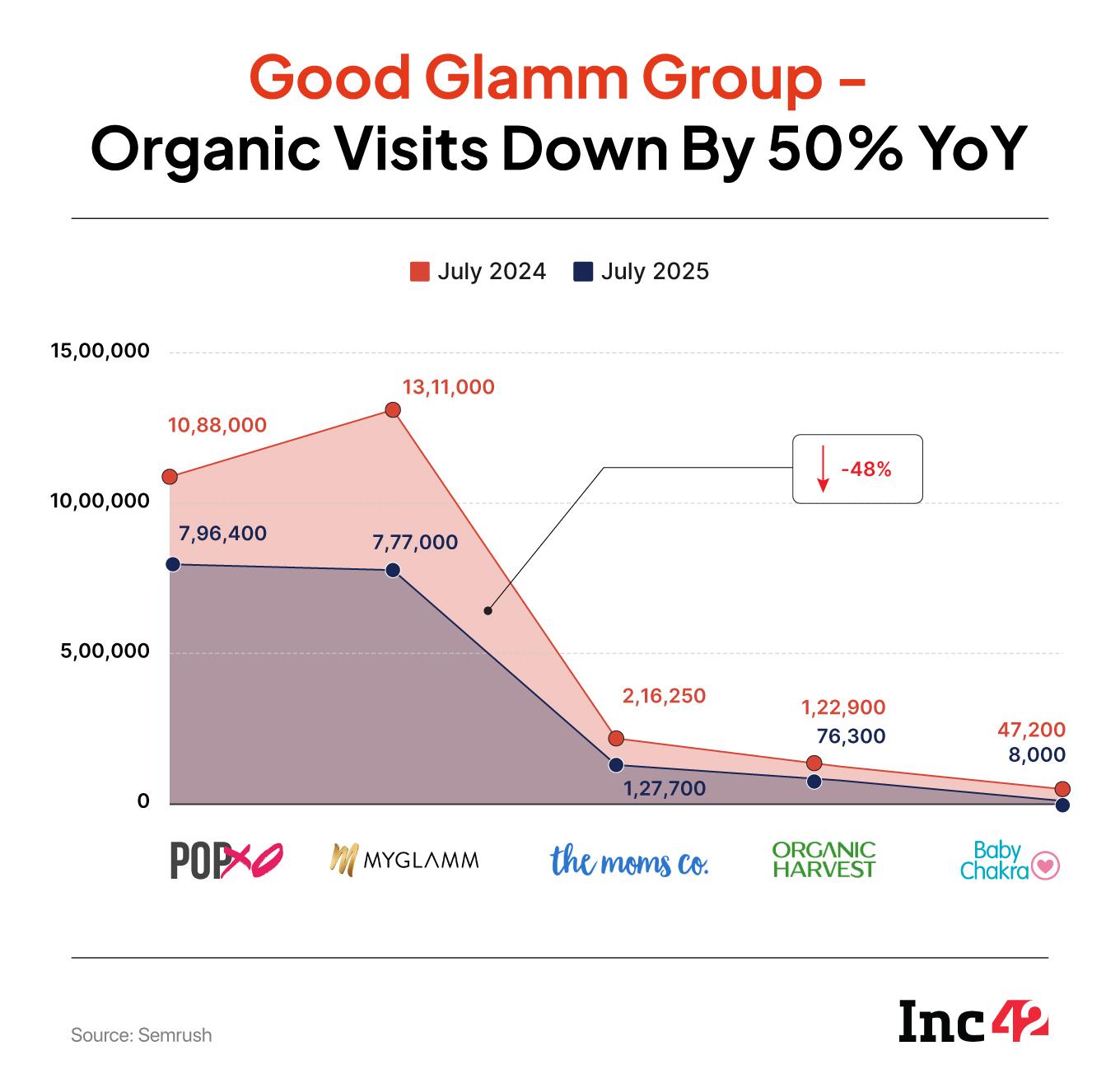

Notably, at its peak, Good Glamm Group claimed to operate over a dozen brands across beauty, wellness, personal care, and content. Today, the company’s core content platforms like PopXO continue to operate with reduced staff. It remains unclear how long these platforms can sustain operations amid the cash crunch.

Its own brand, MyGlamm, is facing difficulties. The website is currently experiencing numerous technical issues and bugs, possibly indicating a downsizing of their engineering team.

As of now, the company still owns MyGlamm, Organic Harvest, Moms Co, POPxo and Good Creator Co brands. But a cursory look on marketplaces would make it clear that inventory is dry and products are more or less out of stock.

End Of The Content-To-Commerce Model?According to Sanghvi, late last year, the company was on the verge of selling one of its brands to secure the future of the business.

“Everything was done, but just before we could sign and secure Good Glamm, the CEO of the acquiring company stepped down at the last moment, and the deal fell through. It was a gut punch out of nowhere that sent us scrambling for funding and securing a lifeline,” Sanghvi claimed.

According to him, that triggered a chain reaction of financial strain, leading to salary delays and disruptions in operational payments. These issues directly affected the business, making it difficult to generate cash flow, and even harder to raise funds.

Notably, at its peak, the Good Glamm Group was riding high, valued at over $1.2 Bn. It had big ambitions—wanting to build a “house of brands” by snapping up direct-to-consumer (D2C) companies and turning content into commerce.

Backed by investors like Amazon, Accel, and Prosus, it wanted to combine media, influencers, and products into one giant ecosystem. But things quickly began to unravel.

The problem wasn’t just how much money was spent, it was how it was spent. After acquiring all these brands, Good Glamm centralised operations, marketing, hiring, and product development.

However, it led to confusion, quality issues, and a lot of unhappy teams. Founders and key people from the acquired brands were sidelined. Marketing budgets were slashed, and more importantly, the changes meant that product quality was worse because of changed formulations.

Meanwhile, the company was also burning money in offline retail. It invested in expensive store spaces and paid high fees just to get prime shelf space, but the products didn’t match the premium image they were trying to project. This is evident in the heavy discounting even today when it comes to the few products that are in stock on ecommerce marketplaces.

The group’s much touted content-to-commerce strategy didn’t work. Any traffic it did acquire through content didn’t convert into sales as expected, and the brands failed to stand under the centralised leadership strategy, as they did before the acquisition.

Despite raising some money earlier in 2024, most of that went into fuelling global expansion. The company even signed a celebrity deal with Serena Williams to promote its Wyn Beauty brand in the US, while its Indian brands were crumbling due to lack of attention and funding. It’s not clear whether GGG has invested any further in this brand or whether it has been left on the sidelines amid the cash crunch.

However, at present, Good Glamm’s sales are a tenth of FY24, but the actual financial situation is not clear because no audited financials have been filed in the past two years. The Good Glamm Group’s content-to-commerce bet looks to have failed.

Sanghvi and Good Glamm Group’s vision of becoming a beauty and content powerhouse is now a distant dream. This is yet another house of brands company that is looking more like a flimsy house of cards.

Edited by Nikhil Subramaniam

The post The Fall Of Good Glamm Group: How The House Of Brands Crumbled appeared first on Inc42 Media.

You may also like

Suicide or murder? DOJ, FBI drop big update on Jeffrey Epstein death; debunk conspiracy theories

Pressure from Trump for trade deals before Wednesday deadline, but hints of more time for talks

Trump slams Musk for announcing new party, calls him 'train wreck'

No country should weaponise critical minerals, technology or supply chain, says PM Modi

Haryana: Houses Of 2 Muslim Families Allegedly Vandalised, Set On Fire In Bhiwani Over 'Love Jihad' Charges (VIDEO)