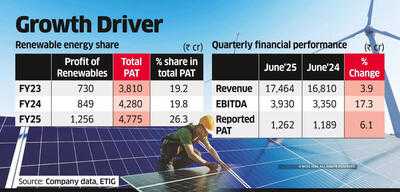

ET Intelligence Group: Tata Power Company (TPCL) is ramping up investments in renewables, which have emerged as a key growth driver for profit and revenue. The segment's share of operating profit rose to 26.3% in FY25 from 19.2% in FY23.

In the first quarter of FY26, this segment was the largest contributor to the company's operating profit before depreciation and amortisationm, or Ebitda. Renewables clocked an Ebitda of ₹1,567 crore, while TPCL's total Ebitda was ₹3,930 crore. Other divisions, including transmission and distribution (T&D), delivered an Ebitda of ₹ 1,345 crore, while that from thermal generation, coal, and hydro segment was ₹974 crore.

The company plans to add 1.7 gigawatts (GW) of renewable energy capacity by the end of the current financial year, which will take its total installed renewables capacity to approximately 6.6 GW. The total clean energy capacity- including renewable, hydro, hybrid and Waste Heat Recovery Systems-was nearly 7 GW as of June.

Adani Green Energy, in comparison, had a total renewable energy capacity of 14.2 GW at the end of FY25, comprising 10.1 GW of solar, 2 GW of wind, and 2.1 GW of hybrid power.

Praveer Sinha, MD and CEO, TPCL, stated during an earnings call that the company's balance sheet was sturdy in spite of a sustained capital expenditure. "We spent in the June quarter ₹3,700 crore against our full year plan of ₹25,000 crore and we are on track to implement all those projects."

The company is currently executing nearly 5.5 GW of renewable energy capacity. It has 2.8 GW of pumped hydro projects in progress, with 1 GW already under construction and the remaining 1.8 GW scheduled to begin within the next nine months.

In addition, work is underway on a 600-megawatt hydro project in Bhutan with plans to scale the total capacity to nearly 5 GW over the next few years. "These projects will give us either similar or better returns than what we will do in any other project," Sinha said.

The company's net debt has risen by nearly ₹2,900 crore to ₹47,578 crore in the first quarter of the current financial year due to higher capex and working capital requirements.

JM Financial Institutional Securities expects the company's net profit to grow by 13% annually between FY25 and FY28. The broking firm has retained a 'buy' call on the stock with a target price of ₹436. The stock was last traded at ₹384.5 on Tuesday on the BSE.

In the first quarter of FY26, this segment was the largest contributor to the company's operating profit before depreciation and amortisationm, or Ebitda. Renewables clocked an Ebitda of ₹1,567 crore, while TPCL's total Ebitda was ₹3,930 crore. Other divisions, including transmission and distribution (T&D), delivered an Ebitda of ₹ 1,345 crore, while that from thermal generation, coal, and hydro segment was ₹974 crore.

The company plans to add 1.7 gigawatts (GW) of renewable energy capacity by the end of the current financial year, which will take its total installed renewables capacity to approximately 6.6 GW. The total clean energy capacity- including renewable, hydro, hybrid and Waste Heat Recovery Systems-was nearly 7 GW as of June.

Adani Green Energy, in comparison, had a total renewable energy capacity of 14.2 GW at the end of FY25, comprising 10.1 GW of solar, 2 GW of wind, and 2.1 GW of hybrid power.

Praveer Sinha, MD and CEO, TPCL, stated during an earnings call that the company's balance sheet was sturdy in spite of a sustained capital expenditure. "We spent in the June quarter ₹3,700 crore against our full year plan of ₹25,000 crore and we are on track to implement all those projects."

The company is currently executing nearly 5.5 GW of renewable energy capacity. It has 2.8 GW of pumped hydro projects in progress, with 1 GW already under construction and the remaining 1.8 GW scheduled to begin within the next nine months.

In addition, work is underway on a 600-megawatt hydro project in Bhutan with plans to scale the total capacity to nearly 5 GW over the next few years. "These projects will give us either similar or better returns than what we will do in any other project," Sinha said.

The company's net debt has risen by nearly ₹2,900 crore to ₹47,578 crore in the first quarter of the current financial year due to higher capex and working capital requirements.

JM Financial Institutional Securities expects the company's net profit to grow by 13% annually between FY25 and FY28. The broking firm has retained a 'buy' call on the stock with a target price of ₹436. The stock was last traded at ₹384.5 on Tuesday on the BSE.

You may also like

'Cherished' teacher and mum of two dies suddenly in Bulgaria tragedy

Miriam Margolyes says 'you can't cancel me' amid calls for her to be stripped of OBE

Tennis LIVE: Cincinnati Open ace questions rules after opponent raises alarm bells

Lee Anderson explodes on GB News over shocking Universal Credit stat

Refund or waive user charge when national highway services are below par: Parliamentary Panel to govt